The MLI transforming your career

Support your colleagues learning journey, in their current and future company roles

Over 500 candidates have now taken the MLI from some of the world’s most prestigious financial institutions including: JP Morgan, BNP Paribas, Mitsubishi UFJ, Bank for International Settlements, Emirates NBD, Deloitte, UniCredit Bank AG, Credit Suisse, Abu Dhabi Investment Authority, CIBC.

World Class Machine Learning, AI and Financial Certificate

The MLI is a graduate-level professional certificate, internationally renowned and a solid demonstration of individual commitment to career development.

- Lifelong Learning: All MLI certified students will have access to any updated syllabus, as part of our lifelong learning commitment.

- Employee Retention: Employee talent attraction & retention can be enhanced and loyalty fostered via the MLI’s cutting edge topics and world class faculty.

- Direct Workplace Knowledge Transference: The highly practical nature of the certificate allows employees to directly use their newly obtained knowledge in your workplace environment. The MLI is a career-enhancing professional certificate.

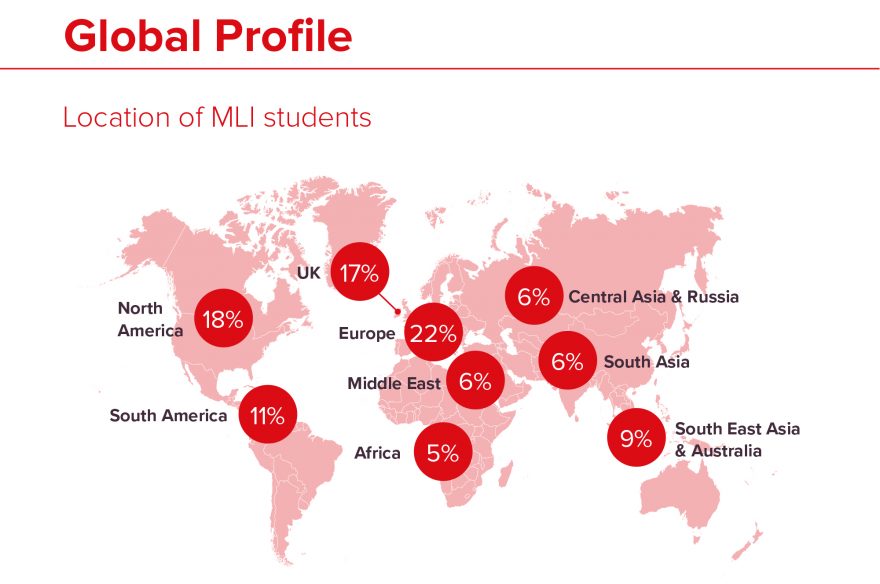

Qualify from anywhere in the world

- Seven-month part-time global programme delivered twice a year.

- All lectures streamed live over the Internet and recorded. Lectures can be viewed at any time.

- Study while working: career-enhancing certificate that can be taken worldwide.

Practitioner Orientated

The MLI delivers learning of practical value, developed and taught by highly experienced practitioners.

Expert teaching and support

The MLI Faculty is an acclaimed team of instructors combining respected academics and renowned practitioners, all specialists in the field of Machine Learning, Data Science and Artificial Intelligence .The Faculty provides mentoring and support during the course and all members are accessible by email or via the online MLI Forum.

Benefit from over 300 hours, exploring the current trends within quantitative finance

Prior to the start of the MLI students are given access to our world class quantitative finance online resource, in preparation for the certificate and to enhance your future learning. This resource offers over 300 hours of the latest research and cutting edge techniques.

MLI Online Primer Resource:

- Maths Primer Refresher Material: For each topic (Linear Algebra, Optimization, Probability & Statistics), there will be a specific quiz to test initial background knowledge. We recommend that you first attempt answering the quiz exercises without looking at any material.

- Python Primer for Data Science. Presented by Nikolaos Aletras, Lecturer at The University of Sheffield

- Recorded Primer: Python for Data Science and Artificial Intelligence. Presented by Paul Bilokon: Founder, CEO, Thalesians & Senior Quantitative Consultant, BNP Paribas

- Recorded Primer: Advanced Python Techniques. Presented by Paul Bilokon: Founder, CEO, Thalesians & Senior Quantitative Consultant, BNP Paribas

Additional MLI Learning Resource:

- Big Data, High-Frequency Data, and Machine Learning with kdb+/q Workshop. Presented by Paul Bilokon: Founder, CEO, Thalesians & Senior Quantitative Consultant, BNP Paribas.

- Big Data and High-Frequency Data with kdb+/q Workshop. Presented by Paul Bilokon: Founder, CEO, Thalesians & Senior Quantitative Consultant, BNP Paribas

Latest Quantitative Finance Conferences:

You will be able to receive up to 400 CPD points for completing this course

The CPD Certification Service was established in 1996 as the independent CPD accreditation institution operating across industry sectors to complement the CPD policies of professional and academic bodies. The CPD Certification Service provides recognised independent CPD accreditation compatible with global CPD principles.